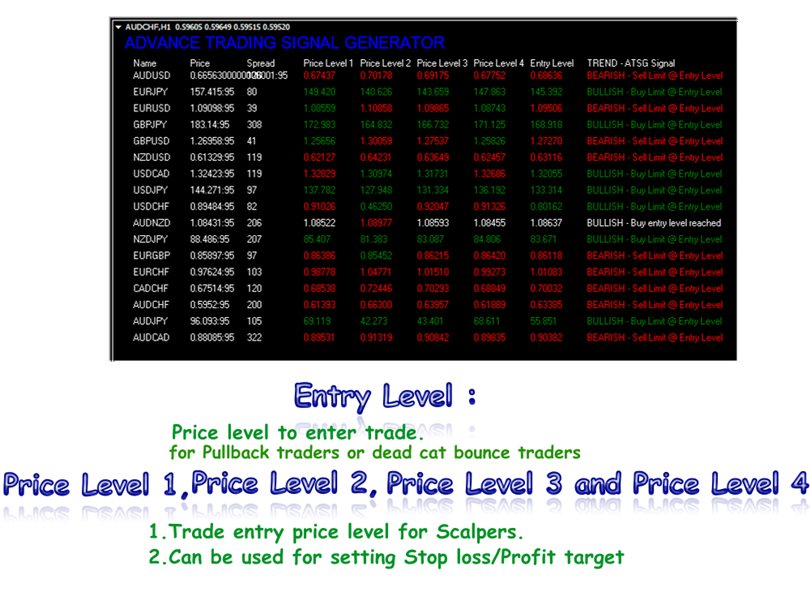

Advance Trading Signal Generator ( ATSG ) is a trading tool for different types of traders, be it newbies, intermediate and professional traders. It scans market across multiple timeframe and use advance mathematical formula on the historical data to know entry level and the trend of the market for each pair. It is suitable for placing pending order and for open market order. It was mainly designed for trend trading using Pullback strategy .

Input Parameters

- Update interval - time for updating signal

- Column Spacing - space between column can be adjusted with this value so as to make indicator fit the chart window.

- Font Size - the size of lettering

How to use ATSG for trading

The values under Price level 1 - 4 and entry level must no be zero. This can be avoided by Making sure that the data for every timeframe for each pair is loaded. It can be done by open the chart of each pair and press "Page up" button on keyboard. Do this process for these timeframe - 1 hour , 4hour, daily, weekly and Monthly.

Note that pending and market order traders can use ATSG to look for market direction before placing order.

How to open Buy positions

1. Look for pair showing "Bullish" under "Trend - ATSG signal" column

2. Place pending Buy Limit order at the price shown under the "entry level" column of the pair or wait for the price to come back to the entry level of the pair before open market buy order.

3. It is recommended to place stop loss few pips below the next lower price level.

4. It is recommended to place profit target few pips below the next upper price level.

5. Opened trades may be closed at the end of the day or week.

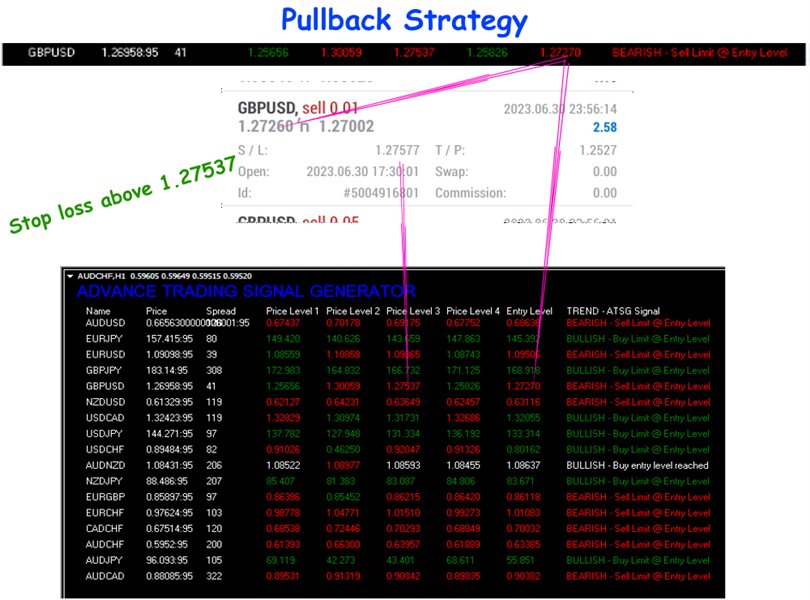

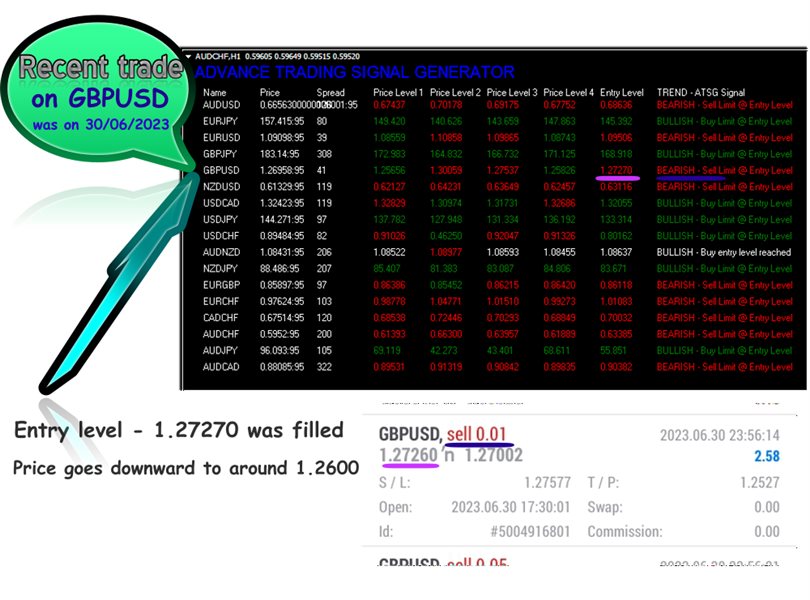

How to open Sell positions

1. Look for pair showing "Bearish" under "Trend - ATSG signal" column

2. Place pending Sell Limit order at the price shown under the "entry level" column of the pair or wait for the price to come back to the entry level of the pair before open market sell order.

3. It is recommended to place stop loss few pips above the next upper price level.

4. It is recommended to place profit target few pips above the next lower price level.

5. Opened trades may be closed at the end of the day or week.